The billionaire Barry Diller is exploring a bid to take management of Paramount, the dad or mum firm of CBS, MTV and Nickelodeon, based on 4 individuals with information of the matter.

Mr. Diller’s digital-media conglomerate, IAC, has signed nondisclosure agreements with Nationwide Amusements, Paramount’s controlling shareholder, the individuals stated. Nondisclosure agreements are a key step in deal making, permitting each side to trade confidential data.

Mr. Diller’s curiosity in Paramount is the newest twist in probably the most complicated — and dramatic — efforts to promote a media firm in a number of years. Paramount reached the brink of a deal in latest months with Skydance, a Hollywood studio, earlier than talks abruptly fell aside.

The nondisclosure agreements had been signed someday after the attainable deal between Paramount and Skydance fell via in June, two of the individuals stated.

It’s unclear how far alongside the talks between IAC and Nationwide Amusements are. Others have additionally expressed curiosity in buying Nationwide Amusements, together with the media and finance government Edgar Bronfman Jr. and Steven Paul, the Hollywood government finest recognized for his work on the “Child Geniuses” franchise.

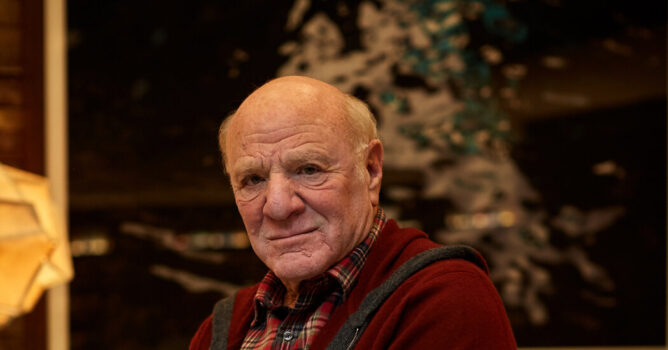

A bid to take management of Paramount could be a coda of kinds for Mr. Diller, 82, who tried to accumulate Paramount Footage within the early ’90s. He was outbid by Sumner Redstone, the bellicose media mogul whose daughter, Shari, now controls the corporate.

Mr. Diller was named head of Paramount Footage in 1974 on the age of 32. He was credited with rejuvenating the studio, creating a cadre of proficient lieutenants, like the longer term Disney chief government Michael Eisner and the studio wunderkind Jeffrey Katzenberg, that turned referred to as the Killer Dillers.

After Mr. Redstone outbid him for the corporate, Mr. Diller set his sights on persevering with to construct his new media empire, placing a collection of audacious offers to develop IAC.

“They received,” Mr. Diller stated in a press release after shedding out to Mr. Redstone. “We misplaced. Subsequent.”

Nationwide Amusements started exploring potential offers final yr. As a part of its talks with Skydance, Shari Redstone, the biggest shareholder at Nationwide Amusements, would promote the corporate to Skydance, whereas Paramount would merge with Skydance via a separate transaction. That deal was scuttled after they may not agree on noneconomic phrases after important shareholder pushback.

By buying Nationwide Amusements, a purchaser would get management of Paramount — and its beneficial studio library — with out having to strike a deal to accumulate the corporate outright. However it might additionally imply taking management of an asset with important liabilities, together with roughly $14 billion in debt and cable companies going through important headwinds.